Switching to a New Payments Provider: The Business Case for Moving to Lark

Tech

Most teams don’t realise how much money they burn on payment failures, brittle in-house billing logic, and manual support escalations until a pricing change or a scale milestone forces them to look closely.

Switching to a modern payments provider isn’t a “nice-to-have platform upgrade.” It’s a strategic infrastructure decision that affects revenue, customer experience, engineering velocity, and pricing flexibility.

If you're looking to implement Lark, below is the exact framework for thinking through it and writing up the business case.

Copy paste the template or save yourself a heap of time and ask Riff to help you prepare a custom business case for your company, using your numbers. It's free and easy.

1. The Pain (Current State)

Approval gets dramatically easier when your manager can feel the inefficiency.

Common payment & billing pains to highlight:

Fragmented, homegrown billing logic

Because pricing, usage, credits, and entitlements are coded internally:

Engineering becomes the bottleneck for every pricing change

New pricing models require re-architecture

Bugs create invoice disputes and support escalations

Estimated cost:

4 engineers × 3 hrs/week × $180k fully loaded ≈ $56k/year in maintenance.

Revenue leakage

Operational gaps directly reduce MRR:

Failed payments not retried strategically

No real-time usage visibility → customer disputes → credits/write-offs

Manual churn recovery processes

Estimated cost:

At $500k MRR, 1–2% avoidable churn = $60k–$120k lost revenue annually.

High Support Burden → Increased COGS

Customers lack clear usage/credit visibility, generating unnecessary billing tickets:

Refund requests

Downgrades / plan change requests

Invoice confusion

If billing drives 200–300 tickets/month at ~$12/ticket → $28k–$43k/year in support cost.

Slow Pricing Experimentation → Lost Revenue Opportunities

Example: Pricing changes currently take 3–6 weeks due to manual migrations and code changes.

This prevents rapid testing of new AI/usage-based pricing models.

Estimated impact:

Delaying monetisation experiments by even one quarter can cost tens of thousands in missed revenue.

If you can quantify even loosely, add numbers:

“We lose an estimated 2–4% of revenue per month due to failed payments and manual churn recovery.”

“Engineering spends 6–12 hours per week maintaining billing edge cases.”

“Pricing experiments take 3–6 weeks to scope, implement, and QA.”

A strong articulation of pain is what unlocks budget.

2. Desired Outcomes

Tie the new payments provider to measurable business outcomes: revenue, efficiency, flexibility.

What switching to a modern provider like Lark unlocks

Switching to a modern provider like Lark should achieve measurable business outcomes in four categories:

A: Revenue Protection & Recovery

Better payment retry logic

Real-time usage visibility reduces disputes

Entitlements ensure customers are billed correctly

Goal: Reduce involuntary churn by 1–3%.

B: Productivity Gains

No more custom billing logic

No more pricing migrations

No more duplicated entitlements logic across services

Goal: Reduce engineering maintenance by 50–70%.

C: Lower Support Costs

Usage and credit transparency

AI-driven refunds and plan changes

Goal: Reduce billing tickets by 20–40%.

D: Revenue Acceleration

Ability to launch and test pricing models instantly

Ability to support AI-centric, usage-heavy pricing models without rebuilds

Goal: Support pricing innovation without engineering overhead.

3. Options Considered

Managers want to know you evaluated alternatives responsibly.

Status Quo

Maintenance cost persists and grows with complexity

Revenue leakage continues

Pricing changes remain slow

Platform risk increases

Financial risk: Known and rising.

Other Payment/Billing Providers

Cover off on the vendors they would expect you to have considered and outline why, in your view, they fall short:

Hybrid + dimensional pricing still requires custom build

No entitlements engine → engineering cost remains

Usage/credit visibility weak → customer dispute risk stays high

Migrations still manual → slows pricing iteration

Legacy providers not adapting fast enough to AI pricing norms

Implement Lark (Recommended)

Purpose-built for modern pricing

Eliminates nearly all custom billing code

Reduces churn and support workload

Pricing changes require zero migrations

Founders previously built usage-based billing at Stripe → lower execution risk

Financial impact: Highest reduction in operating cost + strongest revenue upside.

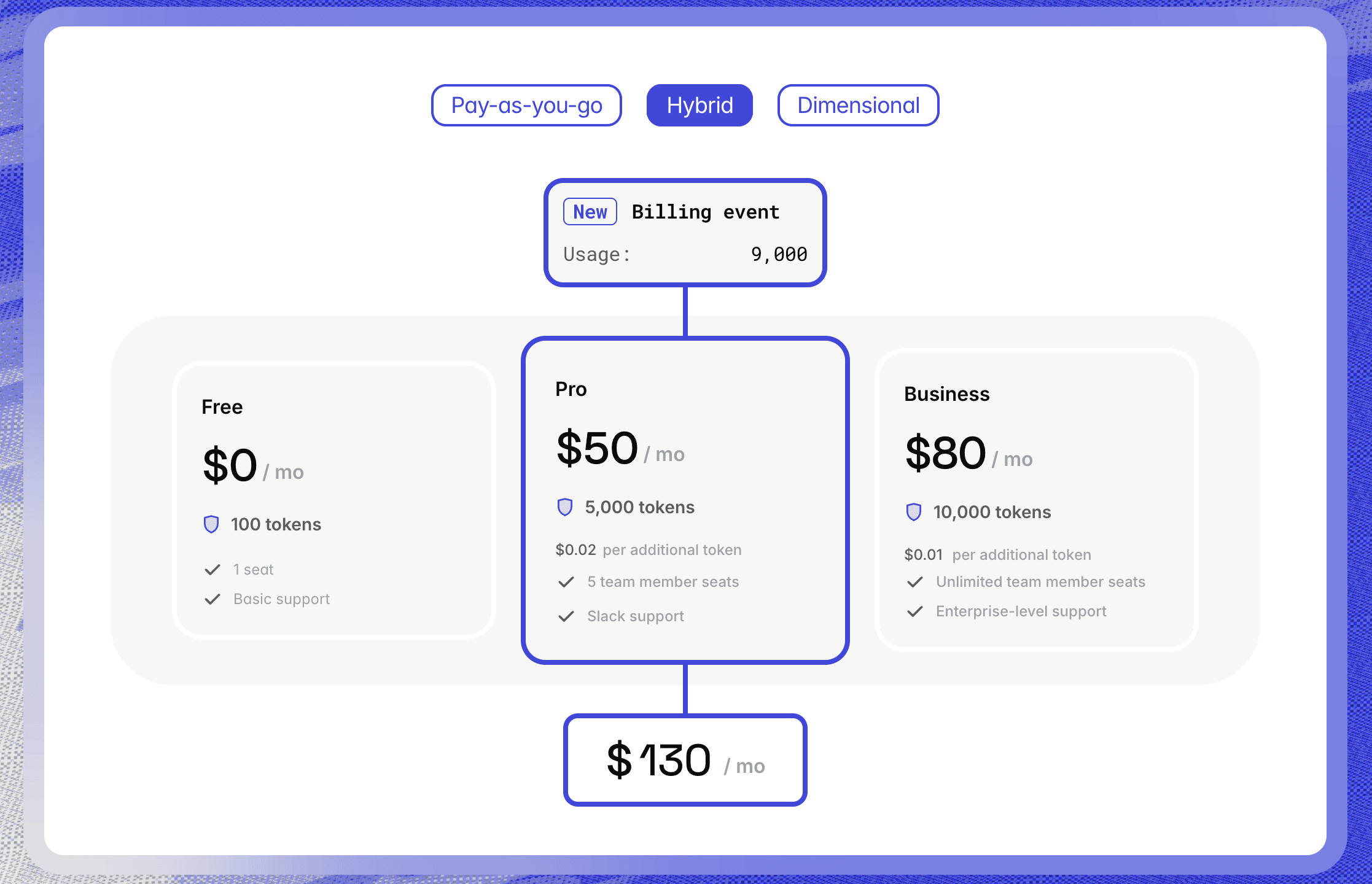

4. Cost and ROI

Total annual benefit (engineering + recovered churn): $116,000

Estimated Lark cost: [$30,000] (you can get pricing from Lark to strengthen your business case)

Net ROI: ~4× return within first year

Breakdown:

Engineering Savings:

624 hours/year → $56,000

Recovered Revenue:

1% churn reduction at $500k MRR → $60,000

Support Cost Reduction

20–40% of billing tickets eliminated → $10k–$30k additional savings

In a nutshell:

If switching providers saves each engineer 150 hours/year and reduces churn by even 1%, Lark pays for itself 4× over.

This is the kind of clarity managers tend to approve fast.

5. Implementation Path (Reducing Risk)

Show leadership the rollout is safe and controlled.

Suggested Plan

Lark will have a recommendation for you, but as an example:

Weeks 1–2 — Configuration

Map pricing models into Lark

Define entitlements

Integrate payments flow

Internal lift: 1–2 engineers part-time

Week 3 — Controlled Pilot

5–10 customers

Validate billing accuracy

Confirm entitlements logic

Minimal customer disruption

Week 4 — Full Rollout

Full migration

Customer billing portal turned on

Downtime expected: None

Month 2–3 — Optimisation

Finance dashboards

Pricing experiments

Automated entitlement refinementManagers appreciate that you’ve mitigated risk with a staged rollout.

The One Pager: Business Case for Switching to a Modern Payments Provider (Lark)

Copy paste or save yourself time and ask Riff.

1. Problem / Current State

Our current billing and payments stack is creating measurable financial exposure, operational inefficiency, and constraints on revenue growth. While individual issues appear technical, the aggregate impact is material to the business.

A. High Engineering Cost to Maintain Billing Logic

Our pricing logic (usage, credits, included quantities, regional pricing, entitlements) is custom-built and fragile. Every pricing change or new feature requires engineering intervention.

Impact:

4 engineers × ~3 hours/week = 624 hours/year

Fully-loaded cost: $56,000 annually

Zero strategic value creation from this time, purely maintenance

The complexity increases with each new pricing model, and the cost will continue to rise.

B. Avoidable Revenue Leakage

We currently experience churn and billing disputes driven by operational limitations:

Failed payments are not intelligently retried

Real-time usage is not surfaced proactively to customers

Invoices lack clarity for usage-heavy plans

Manual churn recovery workflows lead to inconsistent outcomes

Impact:

At $500k MRR, even a 1% reduction in involuntary churn results in $60,000 in retained revenue annually.

We estimate 1–2% of revenue leakage can be directly attributed to billing system shortcomings.

C. High Support Load on Billing Issues

Without a transparent billing portal showing usage, credits, and thresholds, customers escalate to Support unnecessarily.

Impact:

Billing drives ~200–300 tickets/month

At ~$12/ticket, this equates to $28k–$43k/year

These tickets are preventable with clearer billing surfaces

D. Slow Pricing Experimentation = Lost Revenue Opportunities

Pricing iteration is increasingly essential, especially in markets adopting AI-based or usage-based pricing.

Today:

Pricing changes take 3–6 weeks

Require coordinated migrations

Force engineering involvement for testing and deployment

Impact:

Delayed monetisation experiments can cost tens of thousands in incremental revenue per quarter.

This is a strategic barrier, not a technical inconvenience.

2. Proposed Solution: Implement Lark as Our Payments/Billing Provider

Lark provides the flexibility and automation necessary to eliminate maintenance work, reduce churn, support AI-era pricing models, and improve customer experience — with minimal implementation effort.

Key Financial Outcomes

A. Reduced Engineering Overhead

Lark removes the need for custom billing logic entirely:

Usage tracking

Credits and included quantities

Per-seat allowances

Regional/dimensional pricing

Feature entitlements

Outcome:

~50–70% reduction in billing maintenance workload.

B. Revenue Retention & Recovery

Lark’s pricing engine, entitlement logic, and customer portal help ensure customers are billed accurately, understand usage, and proactively avoid overages.

Outcome:

1–3% reduction in involuntary churn

= $60k–$180k/year retained revenue at current scale.

C. Lower Support Costs

Real-time usage dashboards, AI-assisted refunds, and self-serve plan management reduce billing-related ticket volume.

Outcome:

20–40% fewer billing tickets

= $10k–$30k annual savings (not included in the ROI headline number but meaningful to COGS).

D. Faster Time-to-Revenue Through Instant Pricing Changes

Lark removes the need for migrations when pricing changes. New pricing models can be launched or tested in days, not weeks.

Outcome:

Accelerates monetisation and supports experimentation without additional headcount.

3. Options Considered

Option 1: Maintain Status Quo

Engineering cost continues to rise

Revenue leakage persists

Pricing agility remains constrained

Higher operational risk as business complexity grows

Financially: This is the highest-cost option over 12–24 months.

Option 2: Consider Other Billing Providers (Stripe Billing, Chargebee, Paddle, etc.)

These platforms fall short in areas critical to our pricing and growth strategy:

Hybrid / dimensional pricing still requires custom code

No entitlements engine → billing logic remains decentralized

Usage visibility insufficient → customer disputes persist

Migrations for pricing changes remain manual

Not built for rapid iteration or AI-driven pricing needs

Financially: Moderate improvement, but major cost drivers remain.

Option 3: Adopt Lark (Recommended)

Purpose-built for modern usage, credit, and AI-centric pricing

Eliminates custom billing logic entirely

Built-in entitlements reduce errors and disputes

Pricing updates require zero migrations

Strong leadership DNA (team built Stripe’s usage billing stack)

Financially: Delivers the highest savings and revenue upside with the lowest operational risk.

4. Cost and ROI

Headline ROI

Total annual benefit (engineering + churn recovery): $116,000

Estimated annual Lark cost: $30,000

Net ROI: ≈ 4× in Year 1

Detailed ROI Assumptions

Engineering Time Saved:

624 hours saved

$56,000 in regained productivity

Revenue Recovered (1% churn reduction):

$5,000/month

$60,000/year retained

Total Quantified Benefit: $116,000/year

If switching providers saves each engineer ~150 hours a year and reduces churn by even 1%, Lark pays for itself 4× over.

This ROI does not include support cost savings or revenue acceleration from faster pricing iteration — meaning actual ROI is likely higher.

5. Implementation Plan (Risk Mitigation)

A low-risk, time-bounded migration approach:

Weeks 1–2

Configure pricing models in Lark

Set up entitlements and usage tracking

Integrate payments flow

Internal effort: 1–2 engineers (part-time)

Week 3

Pilot with ~5–10 customers

Validate accuracy of metering, credits, and invoices

Week 4

Migrate all customers

Enable customer billing surfaces

Expected downtime: None

Customer impact: Minimal

Month 2–3

Deploy finance dashboards

Begin pricing experiments

Optimise entitlements and automation

This structure demonstrates contained delivery risk and predictable execution.

6. Recommendation

Approve the adoption of Lark as our payments and billing provider.

This transition reduces operational inefficiency, improves revenue reliability, and positions the company to support modern, scalable pricing models without adding headcount or engineering complexity.

The financial case is clear: Lark delivers a 4× ROI through reduced churn and reclaimed engineering productivity while improving customer experience and accelerating monetisation.

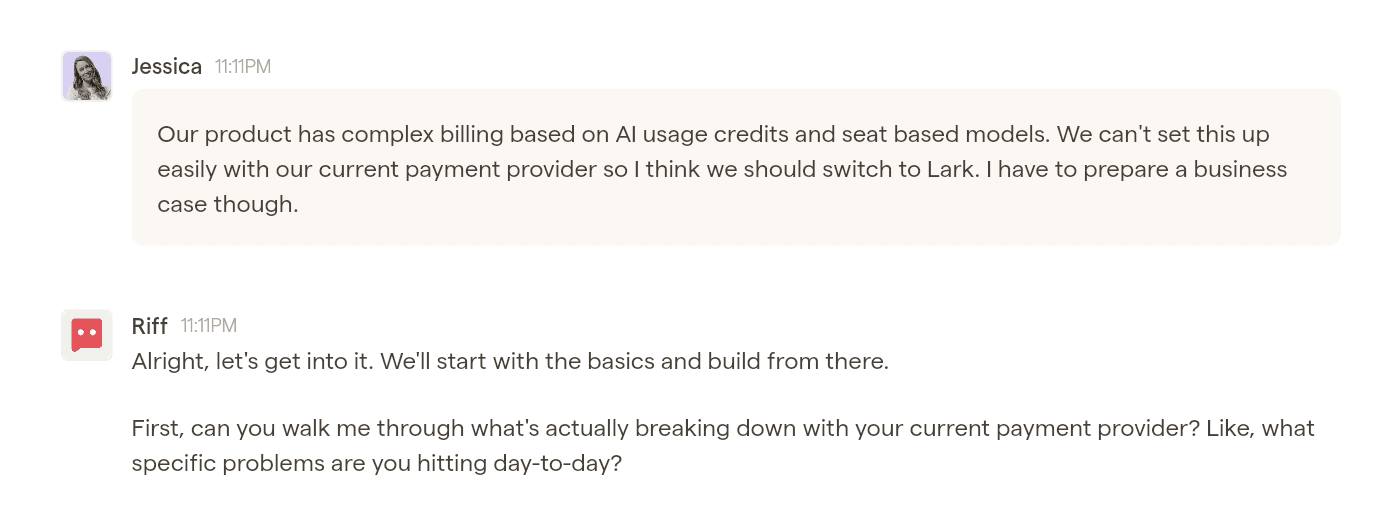

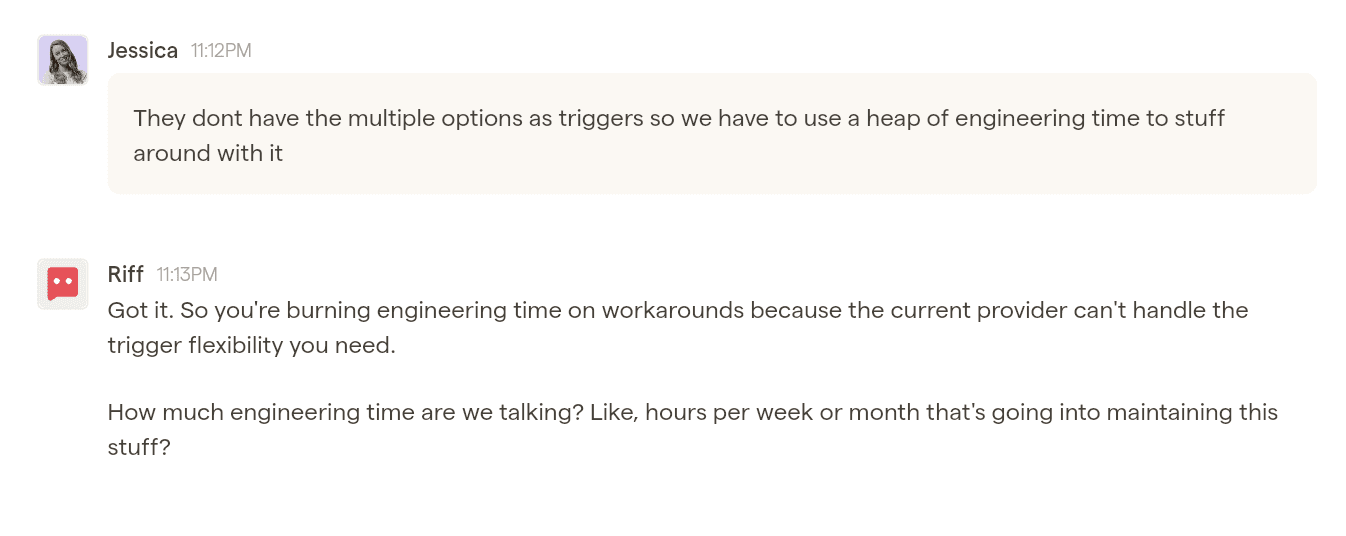

Riff Helps You Get a Decision Faster

Most AI tools give you fluffy irrelevant text you still have to rewrite. Riff helps you stress-test assumptions, helps you calculate the ROI, it asks the questions your manager will so you look 10× more prepared, you can involve multiple collaborators and build a polished, decision-ready business case in minutes. Try it - it's free.